how much is inheritance tax in georgia

All inheritors of the vehicle must sign the title application. The effective rate state-wide comes to 0957 which costs the average Georgian 155130 a year based on the median home value in the state of 157800.

States may also have their own estate tax.

. Its around 870 per. If the estate is appraised for up to 1 million more than that threshold the estate tax can be in excess of 345000. Georgia state offers tax deductions.

Georgias estate tax is based on the amount allowable as a credit for state death taxes on the federal estate tax return Form 706. It is not paid by the person inheriting the assets. The tax is paid by the estate before any assets are distributed to heirs.

Related

- Matt Turner

- spotify keeps crashing iphone 10

- crunch fitness league city facebook

- haagen dazs coffee ice cream bar

- hilton hotels in shelbyville tn

- cypress tree laws in louisiana

- how to file a class action lawsuit in massachusetts

- playing card size in inches

- hotels in san jacinto ca

- mexican food in huntington wv

Surviving spouses are always exempt. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. If the vehicle is currently in the annual ad valorem tax system the family member has the option of staying under annual ad valorem OR paying full one-time TAVT.

How estate taxes work. Across the state rates range from a low of 045 percent in Fannin County to a high of 166 percent in Taliaferro County. First an executor is entitled to receive 2 12 percent of all money brought into the estate and 2 12 percent of all money paid or distributed out of an estate.

Based on the value of the estate 18 to 40 federal estate tax brackets apply. How much is Georgia inheritance tax. The original title application must be submitted.

Inheritances that fall below these exemption amounts arent subject to the tax. If the vehicle is currently in the TAVT system the family member can pay a reduced TAVT rate of 5 of the fair market value of the vehicle. State inheritance tax rates range from 1 up to 16.

Any deaths after July 1 2014 fall under this code. A title is required for all motor vehicles 1986 and newer. Most estate taxes are levied at the federal levelbut many estates arent subject to them.

Jurisdictions located in the state may charge additional sales taxes. The state income tax rates range from 1 to 575 and the general sales tax rate is 4. The tax is paid by the estate before any assets are distributed to heirs.

Georgians pay below-average for property taxes. Charitable and nonprofit organizations dont pay a tax if the amount is less than 500 but 10 percent of anything over the amount. Inheritance - T-20 Affidavit of Inheritance required.

Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. As of 2021 only estates worth more than 117 million are taxed and only on the amount that exceeds that number.

Other heirs pay 15 percent tax as a flat rate on all inheritance received. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax.

If any inheritor is not able to visit the tag office the form can be filled out online printed and signed. What is the inheritance tax rate in GA. The 4 sales tax puts Georgia in the bottom 20 of the country.

Any estate worth more than 118 million is subject to estate tax and the amount taken out goes on a sliding scale depending on how much more than 118 million the estate is worth. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier.

Keith Cochran P C Certified Public Accountant Cpa Serving The Chattanooga Area And Northwest Georgia Certified Public Accountant Money Matters Cpa

Is There A Florida Inheritance Tax Robert J Kulas Reverse Mortgage Credit Repair Credit Repair Companies

Property Investment Financial Planning Inheritance Tax Ltd Company Versus Private Personal Ownership Anyone Inheritance Tax Investment Property Inheritance

Watch Mail For Debit Card Stimulus Payment Prepaid Debit Cards Debit Card Visa Debit Card

Taxation In Georgia No More Tax

What You Need To Know About Georgia Inheritance Tax

What Is Inheritance Tax And Who Pays It Credit Karma Tax

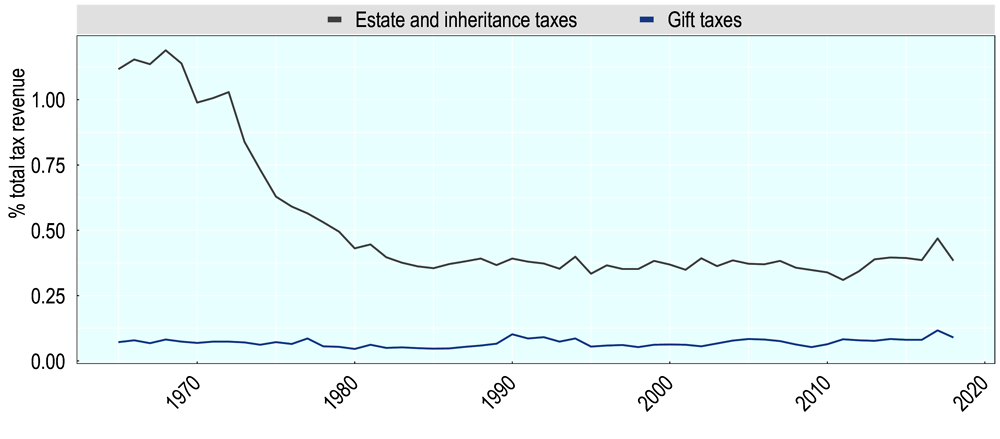

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

What You Need To Know About Georgia Inheritance Tax

The Updated Version Of The Terrible Towel Dailysnark Com Steelers Pittsburgh Pittsburg Steelers

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

He Has A Point Lear New Yorker Cartoons King Lear Cartoon Posters

Taxation In Georgia No More Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Estate Planning And Trust Documents 3 Ring Binder Zazzle Com Estate Planning Ring Binder Binder Design

Does Georgia Have Inheritance Tax